Hepburn Shire ratepayers may see rates of 10% applied in the 2025/26 financial year if an application to the Essential Services Commission is successful.

At a special meeting to adopt the Financial Vision from 2024 to 2027, Councillors authorised the CEO to prepare and submit an application for a rate cap variation for the 2025/26 financial year of 10% including the applicable rate cap. It is anticipated that this would raise approximately $1.56 million in additional revenue.

In subsequent years, rates would return to levels consistent with the rate cap but the cap would be determined by the previous year’s total rates revenue thereby perpetuating the increased revenue into future years.

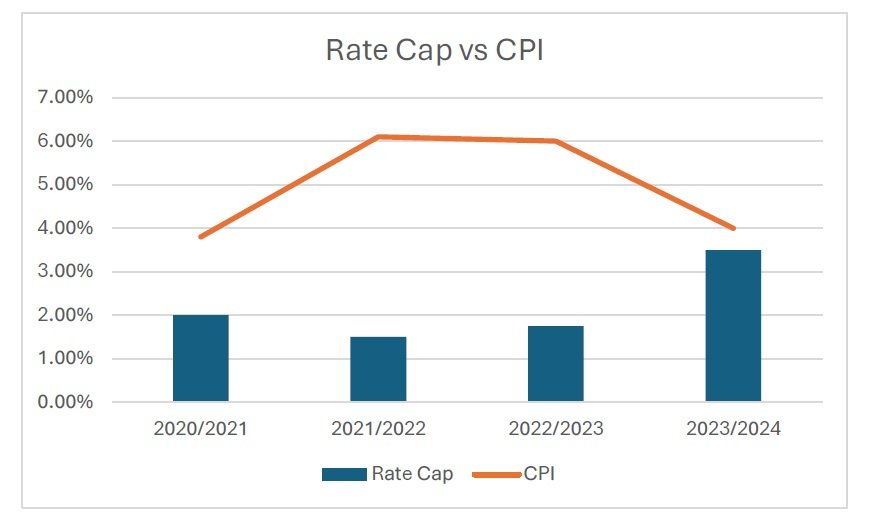

In recent years, the Rate Cap has been consistently below the CPI. Given that rates comprise about 68% of Council income, this has resulted in successively greater cash shortfalls in the Council budget.

Council will begin the process of making an application to the Essential Services Commission (ESC), which is required to be submitted between 1 February to 31 March and the ESC must notify Council of their findings within 2 months of receipt of the application.

To support the most vulnerable in our community, Council approved a rebate to assist eligible pensioners from $21 to $42. This would be on top of the state government rates rebate of 50% of the current year rates to a maximum of $259.50. Ratepayers would continue to have the ability to apply for special payment arrangements based on financial hardship.

In the Mayor’s Message this week and in a report in The Wombat Post earlier this month, the parlous state of the Council finances was outlined. The Draft Annual Financial Report received by Council at their regular meeting earlier this week, shows and adjusted underlying deficit of $13.6 million for the 2023/24 financial year, up from the 2022/23 deficit of $11.3 million and the 2021/22 deficit of $9.6 million.

The Financial Vision for Hepburn Shire, which will guide budgeting over the next four year period, forecasts a cash shortfall of $4 million from 2025/26 onwards.

Mayor, Cr Brian Hood, said that for many years and especially throughout this term, Council has been grappling with financial difficulties due to the sharp increase in costs of service delivery and construction; the small and dispersed population base; a very limited range of additional revenue options; recovery from numerous costly natural disasters; and a low-rate base since amalgamation.

“Our Shire has been adversely impacted by rising inflation affecting the delivery of services and infrastructure, cost shifting from other levels of government, and extraordinary costs associated with the recovery from recent flooding and storm events. As a rural council we have limited opportunities for alternate income streams, and the financial sustainability of all Councils is of concern to many,” said Cr Hood.

In 2024, Council submitted to two major inquiries initiated by Federal and State governments to assess the financial sustainability and service delivery standards of local governments. These inquiries are expected to release findings in late 2024/early 2025.

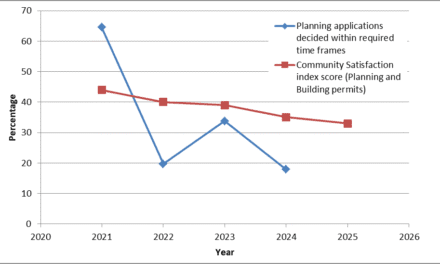

Council hosted an online survey inviting ratepayers, residents and visitors to provide feedback and share their priorities regarding service delivery, community infrastructure renewal or upgrades, and the potential for a rate increase. The survey identified that 62% of the community were open to some rate variation above the rate cap but38% of community were opposed.

The scope of capital works programs have already been curtailed to renewal works and the tight cash environment constrains the ability to service any additional borrowings. The options to address the cash shortfall are the further reduction of operation costs through service reductions and changes and seeking a rate variation, or a combination of the two.

In the 2024/25 Budget, Council determined to implement reductions to operational budgets by $1.56 million and save an additional $2.44 million from rates revenue and from operational and service delivery savings. In cutting costs, Council will seek to minimise the impact on services but some reduction in service delivery is inevitable.

The detail of the operational and service delivery changes will be determined over the coming months, as Council creates their Council Plan 2025-29.

The Financial Vision and the current and projected financial outlook will be key considerations in the development of the Council Plan 2025-29 and Financial Plan 2025-34. These plans must be adopted in accordance with deliberative engagement practices by no later than 31 October 2025 in accordance with the Local Government Act.

This article is based in part on a media release from Hepburn Shire Council.