Ratepayers in Hepburn Shire have begun receiving their rates notices this week.

Rates and charges make up over half of Council’s annual budgeted revenue and are vital to delivering services such as parks and gardens, waste collection, local road maintenance and construction, libraries, public sporting and recreation facilities, and much more.

The increase to Council’s rate revenue has been capped at 3.5 percent in line with the Victorian Government’s Fair Go Rates System. This compares to a six percent CPI increase in the year to June 2023.

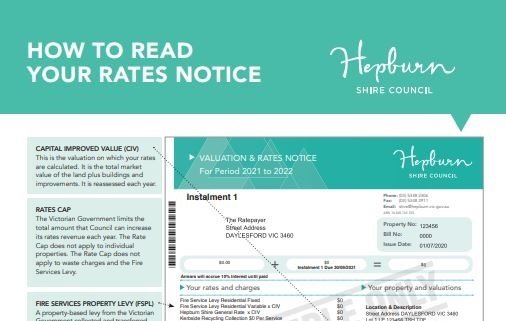

Rates are set according to the value of your property. The Valuer General values all properties in Victoria every year, a process a process which is independent of councils. These valuations are used by Council to calculate rates.

In order to calculate rates, the total amount of revenue to be raised by Council in general rates is divided by the total value of all rateable properties in the Shire. The resulting figure is called the ‘rate in the dollar’. Council then applies a ‘rate in the dollar’ to the assessed value of each property. This rate differs depending on the type of property. For example, residential, commercial and farming properties each have a different rate in the dollar.

Property valuations vary from year to year. Some properties increase in value substantially while others may stay the same or may actually decrease. The 3.5 percent cap on rates is on the total pool of rates income to council so some ratepayers may find that their rates decrease even though their property value is unchanged. This can happen because other properties have increased in value and those owners pay a higher proportion of the total rates pool.

This year, about 52 percent of rateable properties within Hepburn Shire will incur a rate increase lower than the 3.5 percent rate rise cap.

- 36 percent of residential properties will actually see a reduction in rates compared to last year.

- 16 percent of residential properties will incur an increase in rates of less than 3.5 per cent compared to last year.

- 48 percent of residential properties will incur an increase in rates of more than 3.5 per cent compared to last year.

Ratepayers will also see waste charges on their rates notices. This includes a waste management charge that is levied on all properties and collection charges that are based on the service received. A fire services property levy is also included on rates notices, with 100% of the levy passed onto the state government to fund fire and emergency services in Victoria.

The Victorian Government provides pensioners with a concession on rates and charges. This concession is an annual capped amount set by the Department of Human Services and in 2023/2024 is $253.20. There is also a rebate of $50 available against the Fire Services Property Levy.

Council also offers an additional $21 rebate for pensioners who qualify under the state government pensioner rate remission scheme. WHepburn Shire is one of the few councils which offers this additional rebate. Eligible pensioners can apply by contacting Council.

Mayor, Cr Brian Hood acknowledged the current economic situation is causing financial pressure on households.

“We know financial struggles are real for many households. If you are having difficulty paying your rates, please get in touch with our Rates Team. There is a lot of information on our website relating to rates, including frequently asked questions and information on how to pay your rates,” he said.

The Rates Team can be contacted on (03) 5348 2306 to discuss arranging a payment plan in line with Council’s hardship policy.

Find out more about rates at www.hepburn.vic.gov.au/rates.