Rates notices will soon be landing in mailboxes across Hepburn Shire. Residents are expecting a substantial increase because of the Essential Services Commission decision to allow a 10% increase in rates for Hepburn Shire. Many residents are asking how our rates compare with neighbouring shires.

In order to answer this question, The Wombat Post has extracted information from the annual budget statements of Hepburn Shire and the neighbouring shires of Macedon Ranges, Mount Alexander, Moorabool and Ballarat.

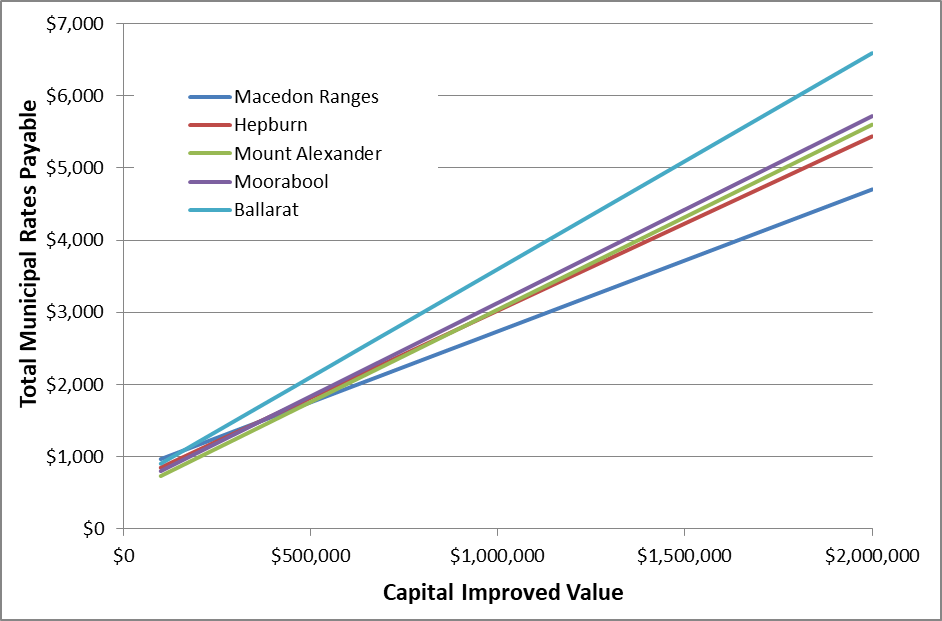

The analysis shows that for properties with a capital Improved Value between $500,000 and $1 million, rates are comparable to most neighbouring shires and substantially less than for Ballarat City residents.

A typical rates notice can include several components:

- General Rates: This is the largest part of most rate notices. It is calculated by multiplying the Capital Improved Value (CIV) of your property by a rate in the dollar set by council. Councils apply differential rates for different types of properties. For example, the rate for commercial properties in Hepburn Shire is set at 120% of the General Rate which applies to residential properties.

- Municipal Charge: This is a flat fee applied equally to all rateable properties to cover the administrative costs of council governance. Legislation limits this charge to no more than 20% of total rates revenue. Effectively, it is a “user” tax. Hepburn Shire does not levy a Municipal Charge; nor do most neighbouring shires except Macedon Ranges which levies a Municipal Charge of $212.

- Waste Service Charges: These are fixed annual fees that cover kerbside waste collection services. Most councils charge separately for landfill, recycling, and organics bins. These charges are not subject to the rate cap, which means they can increase more significantly year-on-year if service costs rise. However, councils are obliged to run waste collection services on a break-even basis. At $610, Hepburn Shire Kerbside Waste charges are the highest of neighbouring councils.

- Emergency Services Volunteer Fund (ESVF): This is a state government charge collected by councils but passed on to the Victorian Government to fund the state’s emergency services. It appears as a separate line item on your rates notice.

- Environmental Protection Authority (EPA) Levy: This is a charge linked to the cost of disposing waste at landfills regulated by the EPA. It is usually embedded within waste charges and contributes to the overall cost of waste management.

In Victoria, municipal rates are set by local councils each year in accordance with the Local Government Act 2020 and overseen by state regulations, including the Fair Go Rates System (FGRS), which caps the amount councils can increase rates across the board. The Victorian Government introduced the Fair Go Rates System (FGRS) in 2016 to protect ratepayers from excessive increases. Each year, the Minister for Local Government sets a maximum cap. Councils are not allowed to raise total general rate revenue above this cap unless they apply for an exemption from the Essential Services Commission (ESC). This year, Hepburn Shire was one of just a few councils to receive an exemption, allowing a 10% increase to address financial sustainability concerns.

The rate cap does not apply to waste charges, municipal charges or state government levies such as the ESVF or EPA levy.

Rates vary depending on the number of rateable properties in a municipality, the level of services offered, and how efficiently councils operate. Rural councils like Hepburn, with a small ratepayer base and limited commercial activity, face more pressure to raise revenue from households to maintain services.

Is it important to note that the rates paid by an individual ratepayer is affected by both the value of their property and where that ranges within their LGA. Since the rate cap applies to the total income for an LGA, not the rates levied on an individual property, a ratepayer may find that their rates decrease if other properties have a relatively greater increase in their CIV.

The table below compares the General rates, municipal charges and kerbside waste collection charges for the neighbouring councils of Moorabool, Macedon Ranges, Mount Alexander and Ballarat City to rates for Hepburn Shire. The table does not include the ESVF levy. Based on these values, the total municipal component of the rates notice has been calculated for properties ranging from $250,000 to $2 million.

| Hepburn Shire | Mount Alexander | Moorabool Shire | Ballarat City | Macedon ranges | |

| General rate | 0.002414 | 0.002561 | 0.00258701 | 0.0029921 | 0.0019654 |

| Municipal charge | 0 | 0 | 0 | 0 | 212 |

| Kerbside Waste | 610 | 478 | 544 | 606 | 560 |

| Capital Improved Value ($) | Rates payable | ||||

| $250,000 | 1214 | 1118 | 1191 | 1354 | 1263 |

| $500,000 | 1817 | 1759 | 1838 | 2102 | 1755 |

| $750,000 | 2421 | 2399 | 2484 | 2850 | 2246 |

| $1,000,000 | 3024 | 3039 | 3131 | 3598 | 2737 |

| $1,250,000 | 3628 | 3679 | 3778 | 4346 | 3229 |

| $1,500,000 | 4231 | 4320 | 4425 | 5094 | 3720 |

| $1,750,000 | 4835 | 4960 | 5071 | 5842 | 4211 |

| $2,000,000 | 5438 | 5600 | 5718 | 6590 | 4703 |

The accompanying graph shows that even with the 10% increase in the General Rate and with the relatively high waste collection levy, total rates are on a par with Mount Alexander and Moorabool, well below those payable for the City of Ballarat and somewhat higher than rates payable in Macedon Ranges Shire.

Hepburn Shire Council provides detailed rate information in the Annual Budget which is available on the Council website.