Daylesford District Community Developments Limited, owner and operator of the Daylesford District Community Bank, has released its 2025 Annual Report.

Highlights included:

- Continued strong financial results – profit after tax for the financial year was $49,569 (after sponsorships and donations)

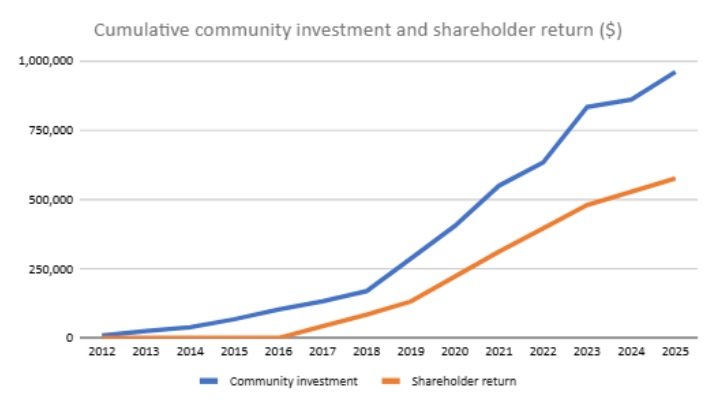

- A significant uplift in community investment – sponsorships and charitable donations were $100,252 (2024: $26,513)

- A fully franked 4 cents per share shareholder dividend

Community Bank Chair Phil Gay said, “We’re very pleased to have been able to deliver another good result for the Daylesford and district community and our shareholders. Our 2025 revenue was 3% lower than the previous year mainly due to tighter margins as a result of competition for deposits and loans. This was typical of results in the banking industry more generally.

“The core of our business is generating revenue through deposits, loans and other banking services. This relies on the on-going support of our customers. We then re-invest a large proportion of the company’s profits back into the community by supporting various local charities and community groups. I’m pleased to say we were able to contribute over $100,000 into community projects and groups by way of sponsorships, including a contribution to the Bendigo Community Enterprise Foundation, despite lower revenue,” he said.

The Company operates under a franchise agreement with Bendigo and Adelaide Bank Limited and has a fully staffed branch in Vincent Street, Daylesford. The branch offers a full suite of banking products and services.

Commenting on the year ahead, Mr Gay said, “The outlook for 2026 is for interest rates to remain steady. This will mean more intense industry competition for deposits and loans and this has been reflected in our results for the first 4 months of the year. Our net interest margin is slightly lower than for the same period last year. This however, is being offset by the fantastic efforts of our branch staff to increase our deposits and loans which are $18 million or 14% higher than at the same point last year. Customer support is driving our growth. The net result is that we are seeing our revenue track ahead of the same period in 2024, which has enabled us to contribute more back into the community.

“The challenge for us is to continue to grow our revenue base while dealing with the inherent growth of our main fixed costs, which are wages and rent. I can assure you that the company is determined to maintain a physical presence in Daylesford. We see this as a community investment in itself,” he said.

For further information please contact Trevor Shard, Company Secretary, (E: companysecretary@ddcdl.com, T: 0404 069 019)

This media release was approved by the Board of Daylesford District Community Developments Limited, owner and operator of the Daylesford District Community Bank.